Sending money to Japan can feel a bit overwhelming with so many options available. Whether you’re supporting a friend, making a payment for goods, or sending money to family, you need to find a reliable way to transfer funds. The best way to send money to Japan often depends on your specific needs, such as cost, speed, and convenience.

There are various methods you can use to send money, ranging from traditional banks to modern online services. Each option has different fees and transfer times, so understanding these factors can help you make the best choice for your situation. Knowing about the choices available ensures you can send your money efficiently and securely.

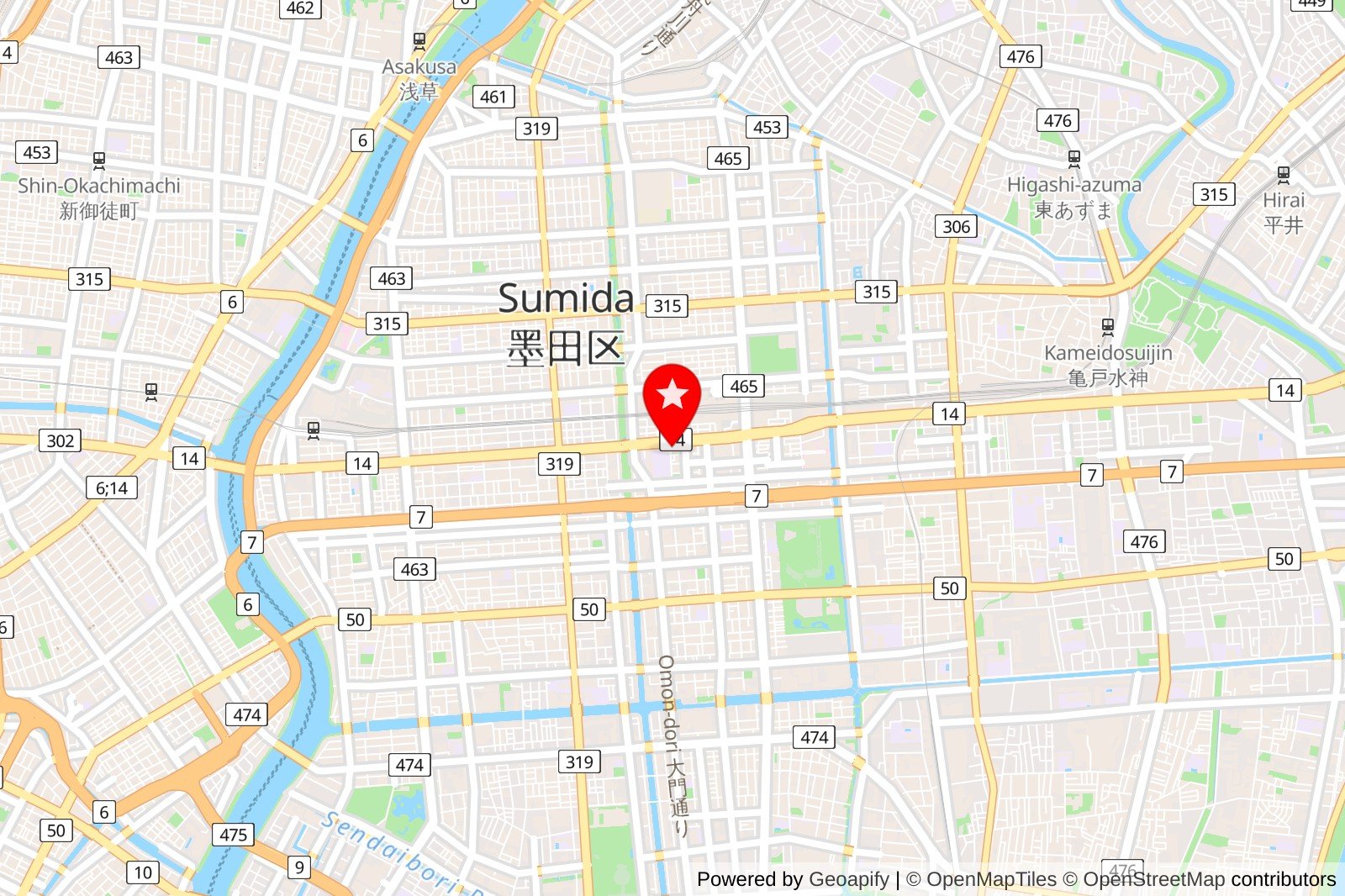

1) Speed Money Transfer Japan K. K.

Speed Money Transfer Japan K. K. is a reliable option for sending money to Japan. They specialize in quick and efficient money transfers. This can be super helpful if you need to send cash to friends or family quickly.

You can expect decent rates and a straightforward process. Their offices are located in different parts of Japan, including Tokyo and Nagoya. This gives you flexibility when choosing where to send money from.

The company is known for good customer service. They aim to make the transfer experience smooth and easy for users. You can ask questions and get help as needed.

If you’re looking for a way to send money hassle-free, consider Speed Money Transfer. They offer a trustworthy service for your money transfer needs.

Rating: 4.2 (11 reviews)

Location: 2 Chome-13-4 Kotobashi, Sumida City, Tokyo 130-0022, Japan

Website: Visit Website

Understanding Money Transfer Options

When you need to send money to Japan, it’s important to know your options. You can choose from bank transfers, online transfer services, and international wire transfers. Each option has its own benefits and costs, so let’s dive into the details.

Bank Transfers

Bank transfers are one of the most common ways to send money. They allow you to send funds directly from your bank account to a Japanese bank account. This method is usually secure, but it can come with higher fees compared to other options.

The transfer time may take 3 to 5 business days. You should ask your bank about their fees and exchange rates. Some banks may charge both a transfer fee and a markup on the currency conversion. It’s good practice to compare different banks for the best deal.

Online Transfer Services

Online transfer services like Wise and PayPal are becoming popular for sending money to Japan. They are generally faster and may have lower fees than traditional banks. For example, Wise offers charges between 0.5% and 1% for transfers, depending on the amount.

Using these services is simple. You just need to create an account, enter the recipient’s details, and follow the prompts. Many services also provide live tracking, so you can see when your money arrives. Just check their fees and the exchange rate before you send.

International Wire Transfer

International wire transfers are another reliable option for sending funds. They are typically faster than bank transfers, often taking only 1 to 3 business days. However, wire transfers can be quite expensive due to high fees.

It’s important to note that both sending and receiving banks may charge fees. This can add up quickly, so keep an eye on the total cost. Additionally, international wire transfers usually require more information, such as the recipient’s bank account number and SWIFT code.

Factors to Consider When Sending Money

When sending money to Japan, there are a few important factors to keep in mind. Understanding exchange rates and fees, transfer time, and security can help you make the best choice for your needs.

Exchange Rates and Fees

Exchange rates can vary widely between money transfer services. It’s essential to compare rates to ensure you’re getting the most value for your money. Some companies might offer low fees but have poor exchange rates, costing you more in the end.

Look for services with transparent fee structures. You want to know upfront what you’ll pay. For example, Wise charges a small, flat fee along with a percentage of the converted amount. Others may have hidden fees that pop up later.

Check if there are additional costs, especially if you’re using a bank. Traditional banks often add hefty fees for international transfers. It’s smart to do the math before deciding.

Transfer Time

Transfer time is crucial, especially if you need to send money quickly. Some services might promise instant transfers, while others can take several days.

For urgent transfers, consider using options that allow cash pickups at agent locations. Services like MoneyGram can be faster and allow your recipient to get cash immediately.

If timing isn’t critical, look for the cheapest service. It might take longer, but it can save you money. Always check the estimated delivery time when choosing a provider, so you know what to expect.

Security and Reliability

Sending money abroad means you want to feel safe about where your money is going. Choosing a reliable service is essential. Look for companies that are well-known, regulated, and have positive reviews.

Check if the service offers encryption and other security features to protect your personal and financial information. This is especially important when dealing with online transfers.

Read customer feedback to see others’ experiences. Reliable services will usually have a proven track record. If you see consistent complaints, it’s best to look elsewhere. Your money deserves to be safe while it’s on the way to Japan.

Frequently Asked Questions

When sending money to Japan, you might have specific questions regarding costs, methods, and services. Here’s a quick guide to help you navigate common concerns.

What’s the most affordable option to transfer funds to Japan?

The most affordable options often include online services like Wise or Remitly. These platforms usually offer lower fees compared to banks. Always check the exchange rates, as they can impact the total cost.

Is PayPal a good choice for sending money to Japan?

PayPal is convenient but can be costly if you choose to fund your transfer with a credit card. It’s advisable to compare fees and exchange rates before deciding if it’s the right option for you.

Can I wire money directly to a Japanese bank account from abroad?

Yes, you can wire money directly to a Japanese bank account. Most banks offer this service, but it might come with higher fees. Make sure to have the correct account details to avoid any issues.

How do I send money to someone in Japan from the USA?

To send money from the USA, you can use services like Western Union or Wise. Both allow you to transfer funds online or in person, giving you options based on your needs.

Is it possible to use Zelle for transactions to Japan?

Zelle does not work for international transfers. It’s strictly for domestic transactions within the USA. For sending money to Japan, consider alternative methods like PayPal or bank transfers.

What’s the best way to send money to Japan from India?

You can often send money from India to Japan using online remittance services. Wise or MoneyGram are popular options that can provide competitive rates and faster transfer times. Make sure to compare multiple services for the best deal.